Solar module manufacturing capacity could exceed 1.5 TW by 2035, says IEA

The International Energy Agency’s (IEA) latest report, which maps out the future evolution of clean energy manufacturing, says the combined global market for PV, wind turbines, electric cars, batteries, electrolyzers, and heat pumps will rise from $700 billion in 2023 to more than $2 trillion by 2035.

October 30, 2024 Patrick Jowett

Global solar module manufacturing capacity is set to exceed 1.5 TW by 2035, according to forecasts from the IEA. Its latest report, “Energy Technology Perspectives 2024,” covers the production of solar, wind turbines, electric cars, batteries, electrolyzers, and heat pumps.

The report uses scenarios like the Stated Policies Scenario (STEPS), which reflects the current policy landscape, and the Announced Pledges Scenario (APS), which assumes governments meet their climate targets, to project the potential growth of these technologies.

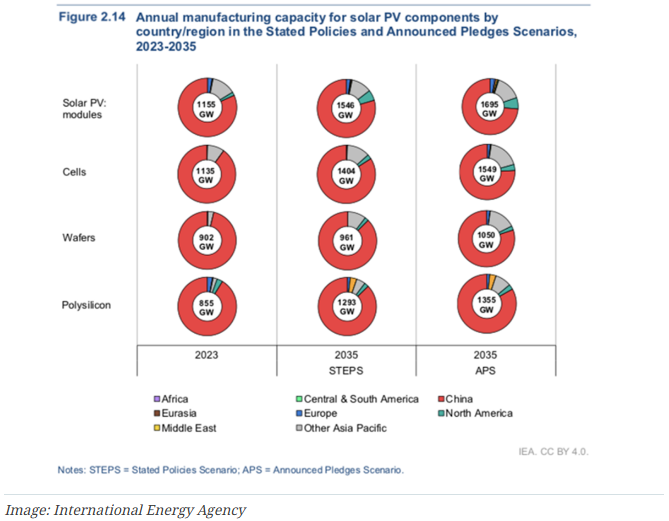

The IEA said global solar module manufacturing capacity could reach 1,546 GW by 2035 under STEPS, with capacity rising to 1,695 GW under APS. In 2023, global capacity stood at 1,115 GW.

China is projected to maintain a lead in solar production, but its market share may drop slightly as projects and policies in other regions drive manufacturing expansion, said the IEA.

US solar module manufacturing capacity is expected to reach 90 GW by 2030 under STEPS, increasing to slightly over 100 GW under APS. The IEA said US demand for solar modules and polysilicon will be met almost entirely by domestic production by 2035, while demand for solar cells and wafers will still rely on imports.

The IEA said Indian solar module manufacturing capacity could reach about 80 GW under STEPS, rising to around 120 GW under APS. In the European Union, the APS scenario would support a goal of meeting 40% of demand through domestic production.

In the long term, differences in cost fundamentals across the global manufacturing market are likely to become increasingly important, the report says. The IEA said this could give a strong competitive edge to regions with low energy prices, including China, India, Southeast Asia, and the Middle East.

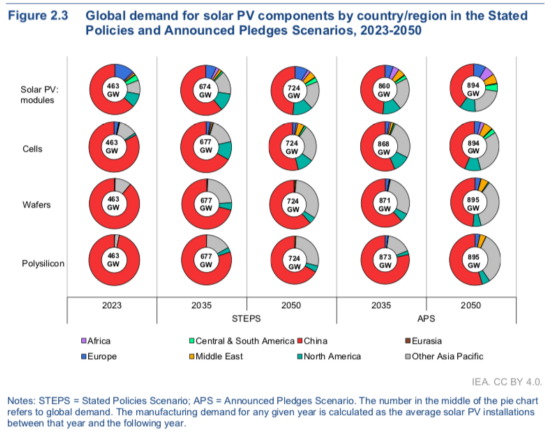

The report forecasts that global demand for solar modules will grow from 460 GW in 2023 to 674 GW in 2035, at an average growth rate of 3% per year, to 724 GW in 2050 under STEPS. Under APS, global solar module demand is expected to reach 860 GW by 2035 and 894 GW by 2050.

China is forecast to remain the main growth engine in global sector demand, reaching around 415 GW in 2035 under both STEPS and APS. India and other emerging markets and developing economies (EDMEs) are expected to take a growing share of the global market in both scenarios, reaching nearly 25% in 2050 under STEPS and 35% under APS.

The IEA said that average investment in the PV supply chain is set to fall in the next few years, from over $80 billion in 2023 to around $10 billion in years 2024 to 2030, then to even lower between 2031 and 2035. The organization said it expects a drop because “current capacity is more than sufficient to meet a significant share of the deployment.” The most investment, it added, will be needed in China, the United States, India, and the European Union.

Based on today’s policy settings, IEA said that the combined global market for solar, wind turbines, electric cards, batteries, electrolyzers, and heat pumps could rise from $700 billion in 2023 to more than $2 trillion by 2035 – close to the value of the world’s crude oil market in recent years.

IEA Executive Director Fatih Birol said that as countries seek to define their role in the new energy economy, energy, industry and trade policy will all become more vital and interlinked.

“Clean energy transitions present a major economic opportunity and countries are rightly seeking to capitalize on that,” Birol said. “However, governments should strive to develop measures that also foster continued competition, innovation and cost reductions, as well as progress toward their energy and climate goals.”